UKPW Easter and Bank Holiday Opening Hours

Please find our bank holiday opening times for 2024 below:

Please find our bank holiday opening times for 2024 below:

With only one week to go until full customs controls apply from Ireland to GB imports, we are resharing HMRC’s communication from December. If you have any questions or concerns about these, please email us at info@ukpworldwide.com where we will aim to answer any queries you may have.

HMRC Communication 19th December 2023

In August 2023, the Government published the final version of the Border Target Operating Model which confirmed that from 31 January 2024 some goods will face full customs controls when moved directly from Irish ports to Great Britain.

Goods will need to complete import processes if they are being imported directly from Ireland into Great Britain (not moving from or through Northern Ireland).

Goods moving from Northern Ireland to Great Britain through Irish ports will also have to complete import processes if they are:

For these goods you will have to follow the import requirements set out in the Border Target Operating Model.

When moving these goods, most traders will need to make import customs declarations at the point of import and will no longer be able to delay making declarations. Ports will be required to control these goods moving from Ireland to Great Britain, meaning that unless they have received customs clearance they will not be released from the port.

What you need to do to prepare to move goods from 31 January 2024

You will need to ensure you, or anyone who moves goods on your behalf, are familiar with the new process from 31 January 2024.

More information on qualifying Northern Ireland goods

The Border Target Operating Model confirmed that import declarations will not be needed for qualifying Northern Ireland goods moving directly from Northern Ireland or indirectly through Ireland to Great Britain, in line with the Government’s commitment to unfettered access. There are some very limited exceptions where import declarations are required, such as an ongoing requirement to provide these for excise goods when moving qualifying Northern Ireland goods through Ireland to Great Britain, and these will be set out in guidance shortly.

When moving qualifying Northern Ireland goods through Ireland to Great Britain for which import declarations are not required through Roll-on Roll-off ports, hauliers will still need to complete a Goods Movement Reference (GMR). They should indicate they are moving such goods on their GMR. Hauliers and drivers will need to provide commercial evidence if asked to confirm that their goods are qualifying Northern Ireland goods for example, a dispatch notice, an invoice, or a consignment note. They will also need access to a travel document issued in the UK setting out the destination of the goods, to show that the goods have merely passed through Ireland.

At inventory linked ports or other locations, similar processes will be used to allow these qualifying Northern Ireland goods to be released from inventories or local systems without requiring electronic declarations.

We will be updating the guidance pages on GOV.UK to reflect these changes.

Further help and support

If you have any questions, visit Imports and exports: general enquiries on GOV.UK.

Dear Valued Clients and Partners,

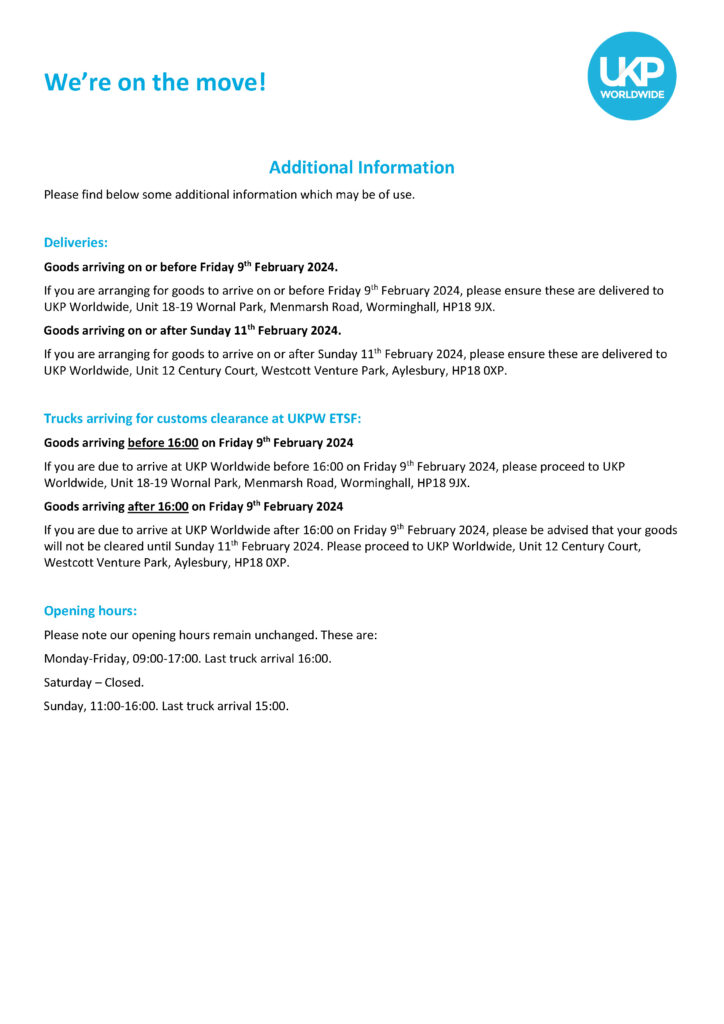

We are thrilled to announce some exciting news that marks a new chapter in the journey of UKP Worldwide (UKPW). As part of our commitment to better serve you and accommodate our growing operations, we are moving to a new larger location.

Effective from Sunday 11th February 2024, UKPW will be relocating from our current location to the spacious and dynamic Westcott Venture Park. This strategic move has been carefully planned to facilitate our continued growth and expansion, allowing us to enhance our services and meet your evolving needs more effectively.

Our new address will be:

UKP Worldwide, Unit 12 Century Court, Westcott Venture Park, Aylesbury, HP18 0XP.

We believe that this move will bring numerous benefits to our valued clients and UKPW. The increased space and improved facilities will enable us to streamline our operations, provide more efficient services, and develop innovative solutions to meet the challenges of the modern global market.

Rest assured that our dedication to delivering high-quality, reliable, and timely services remains unwavering. During the transition period, we will make every effort to minimise any disruptions to our operations and maintain the excellent level of service you have come to expect from us.

We are truly excited about this new chapter in our company’s history and the opportunities it presents. We extend our heartfelt gratitude for your continued support and partnership. We look forward to welcoming you to our new premises and sharing our exciting journey of growth with you.

If you have any questions or require further information about our relocation, please do not hesitate to contact our dedicated Client Services team at ukpclientservices@ukpworldwide.com.

Thank you once again for your trust and partnership. We are excited about the future, and we are grateful to have you with us on this journey.

Best regards,

Lee Bucktrout

Chief Executive Officer

We are pleased to be sharing an important update from HMRC regarding the forthcoming changes required on imports from Ireland to Great Britain. If you have any questions or concerns about these, please email us at info@ukpworldwide.com where we will aim to answer any queries you may have.

HMRC Communication 19th December 2023

In August 2023, the Government published the final version of the Border Target Operating Model which confirmed that from 31 January 2024 some goods will face full customs controls when moved directly from Irish ports to Great Britain.

Goods will need to complete import processes if they are being imported directly from Ireland into Great Britain (not moving from or through Northern Ireland).

Goods moving from Northern Ireland to Great Britain through Irish ports will also have to complete import processes if they are:

For these goods you will have to follow the import requirements set out in the Border Target Operating Model.

When moving these goods, most traders will need to make import customs declarations at the point of import and will no longer be able to delay making declarations. Ports will be required to control these goods moving from Ireland to Great Britain, meaning that unless they have received customs clearance they will not be released from the port.

What you need to do to prepare to move goods from 31 January 2024

You will need to ensure you, or anyone who moves goods on your behalf, are familiar with the new process from 31 January 2024.

More information on qualifying Northern Ireland goods

The Border Target Operating Model confirmed that import declarations will not be needed for qualifying Northern Ireland goods moving directly from Northern Ireland or indirectly through Ireland to Great Britain, in line with the Government’s commitment to unfettered access. There are some very limited exceptions where import declarations are required, such as an ongoing requirement to provide these for excise goods when moving qualifying Northern Ireland goods through Ireland to Great Britain, and these will be set out in guidance shortly.

When moving qualifying Northern Ireland goods through Ireland to Great Britain for which import declarations are not required through Roll-on Roll-off ports, hauliers will still need to complete a Goods Movement Reference (GMR). They should indicate they are moving such goods on their GMR. Hauliers and drivers will need to provide commercial evidence if asked to confirm that their goods are qualifying Northern Ireland goods for example, a dispatch notice, an invoice, or a consignment note. They will also need access to a travel document issued in the UK setting out the destination of the goods, to show that the goods have merely passed through Ireland.

At inventory linked ports or other locations, similar processes will be used to allow these qualifying Northern Ireland goods to be released from inventories or local systems without requiring electronic declarations.

We will be updating the guidance pages on GOV.UK to reflect these changes.

Further help and support

If you have any questions, visit Imports and exports: general enquiries on GOV.UK.

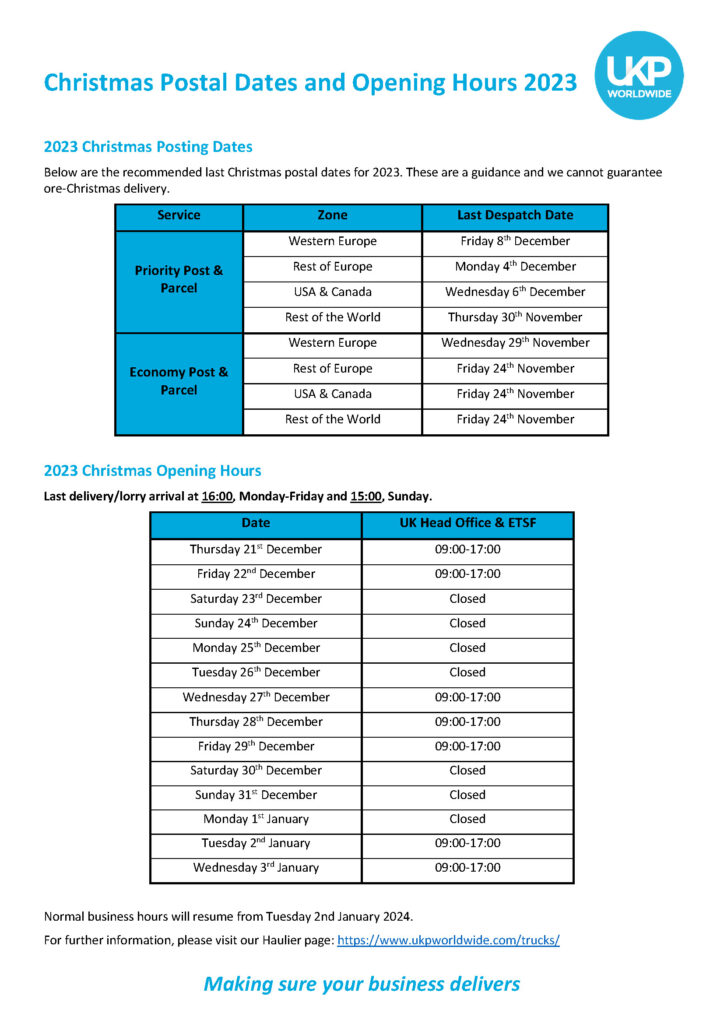

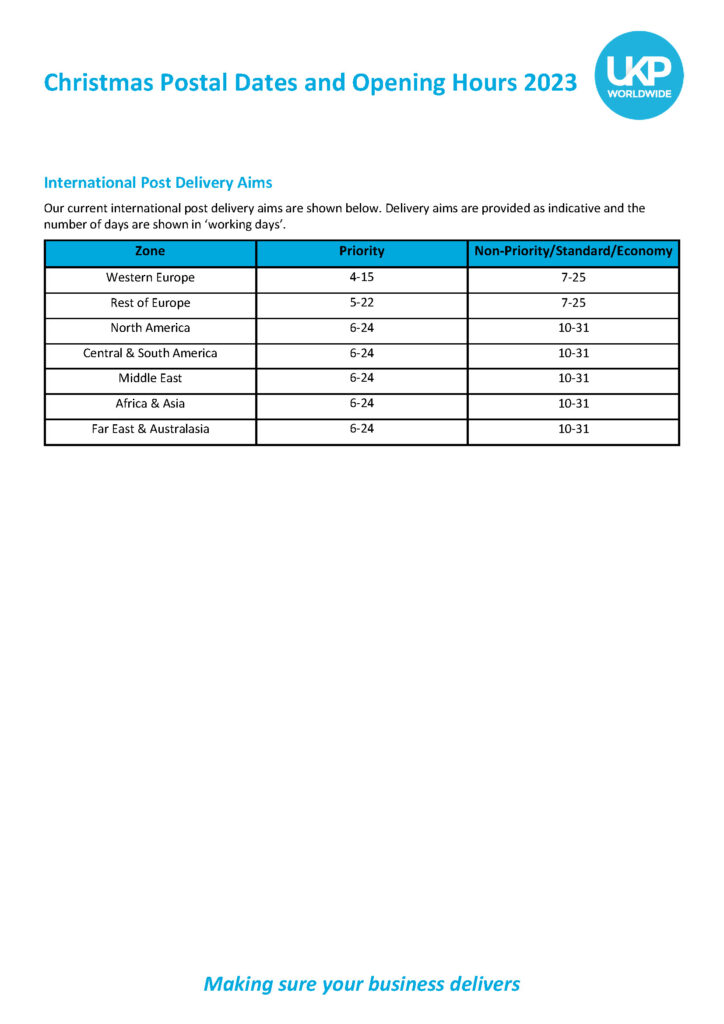

Please find our Christmas last recommended postal dates and Christmas opening hours below.

UKP Worldwide (UKPW) featured in the September issue of Cross-Border magazine talking about the challenges retailers have faced since Brexit and the complex customs regulations that come with exporting to the UK.

Read our full article here: CBM27-00-Digital-HighRes.pdf (cross-border-magazine.com)