Postponed VAT Accounting (PVA)

What is it?

When the Brexit transition period finished UK Customs and VAT legislation was updated. This means all overseas sellers that make any taxable sales in the UK, must register for VAT and account for UK VAT to HMRC. You are considered an overseas seller if you do not have a business established in the UK and make taxable sales of goods to customers in the UK. How VAT is charged depends on whether the trader is selling directly to their customers in the UK or through an online marketplace, the location of your goods at the point of sale, and the total value of the consignment you are shipping.

*Importing Stock to sell

If you are importing goods to the UK and sell through an online marketplace e.g., Amazon, ebay, etc. you will be liable for any Customs Duty & Import VAT when the goods are first imported into the UK. You can register for VAT to reclaim any Import VAT you paid. The normal rules about what VAT can be reclaimed as input tax will apply. UK registered businesses can use Postponed VAT Accounting (PVA). A UK established business must have a permanent physical presence, be registered at Companies House, and employ local staff. A serviced or virtual office is not enough to create an established business. For example, if you sell all goods using an online marketplace and you only have a fulfilment centre in the UK, then you are an overseas seller.

*Overseas Selling through Online Marketplace

If goods are located outside the UK when sold through an online marketplace, they will be liable for UK VAT on sales. The online marketplace will charge and collect this at the point of sale when the goods are sold.

**Selling Direct to consumer – NOT through an Online Marketplace

Any goods sold directly to a UK customer, for example through a trader’s website and not through an online marketplace based in Great Britain, will attract Import VAT and UK Duty if the total order value is over £135. Consignments containing goods with a value of £135 or less, that are outside the UK when sold, will attract UK Supply VAT. Supply VAT should be charged and collected at the point of sale. The £135 limit applies to the total value of items contained within a consignment/parcel. The consignment value should be based on the intrinsic value, which is the price of the goods when they were sold, excluding any transport and insurance costs. This is unless they are included in the price and not separately shown on the commercial invoice and any other identifiable taxes and charges. Unless sent individually, the seller must add the individual values of all items in a consignment together to get the total value of the consignment.

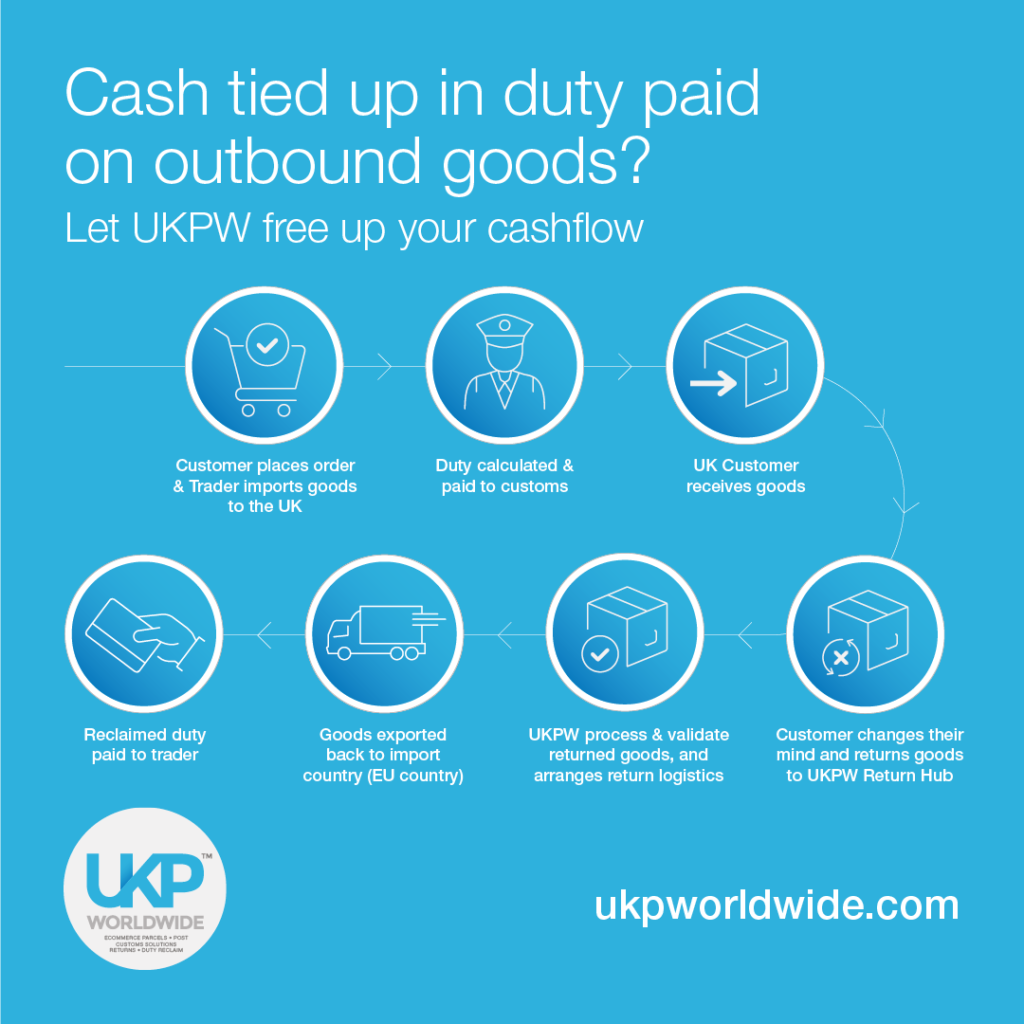

What type of business could benefit?

If your business is registered for VAT in the UK, you can use PVA and account for Import VAT on your VAT Return for goods you import into the UK. If you are a retailer, online trader or manufacturer importing goods from outside of the UK – your business could benefit from improved cash flow when importing goods.

***Want to use an agent to help import goods on your behalf?

You can appoint someone to import goods on your behalf such as a freight forwarder or customs agent. You will need to appoint them, provide written instructions, and advise them on how your business wants to account for its VAT. These instructions are vital so the correct VAT can be paid and accounted for when making your VAT return to HMRC. This ensures all VAT records match the goods that have been imported and you remain compliant.

Want to know more…

If you think your business could benefit from Postponed VAT Accounting or eCommerce Managed Returns & Duty Reclaim, why not email our Sales team at info@ukpworldwide.com.

Disclaimer:

The information provided in this article is for general informational purposes only and is based solely on our experience in that field. It should not be considered as expert legal, financial, or tax advice. We do not provide VAT advice, and any information provided should not be relied upon as a substitute for consulting with a qualified professional. VAT regulations and laws may vary by jurisdiction and can be subject to frequent changes and updates. Therefore, it is essential to seek the guidance of a qualified professional tax advisor who can assess your specific situation and provide appropriate advice based on current legislation. Businesses importing to Northern Ireland are still considered part of the EU VAT area and have different requirements.